Content

On one side, shoppers love the idea of tailored products, specialized service, and fast shipping. On the other side of the ecommerce explosion sits the sheer number of tools allowing entrepreneurs to quickly set up shop and get products in front of buyers. LedgerGurus is a cloud-based, ecommerce-specialized accounting firm. We relieve the stress and overwhelm our clients feel by freeing them from their accounting headaches. We help our clients succeed by giving them solid, reliable numbers to build their businesses with. As you can see, if you really want to tame that ecommerce accounting beast, you need both great tools and, at some point, a great ecommerce accounting specialist.

An eCommerce bookkeeper can keep track of products in the inventory. They can also inform the managers when stock levels are low. They can prepare sales reports to understand product profitability.

How to track inventory in ecommerce bookkeeping

Track your inventory on a monthly or quarterly basis to make sure it’s kept up to date. This is especially important if you process returns or store inventory in multiple locations. Spreadsheets are a simple way to track your transactions.

That means the flat rate shipping income and payments to shipping vendors (like UPS) go to the same place. You won’t be tracking the difference per se, but it ultimately won’t matter since they’re all COGS related. Some e-commerce platforms make dealing with shipping logistics easier by integrating directly with shipping systems. That means your platform can handle collecting shipping charges from the customer and purchasing postage from your logistics provider. However, remember that while that’s one less step for you to worry about, your e-commerce provider will likely take a cut from the transaction. That makes it exceptionally important to have one central place to track inventory, whether or not it automatically updates your books.

Six ecommerce bookkeeping best practices

Competition from other online retailers is as much of an issue as a company that isn’t set up for success financially. Let’s say you own a shoe store and have 50 pairs of shoes in your backroom. With that information, we’ll dive in to truly understand your business and provide you with a custom pricing quote for working together. We understand some clients love being able to text their bookkeeper so you have that option as well. Given all of the moving parts of an eCommerce business, it can be difficult to understand the eCommerce bookkeeping numbers even once they’ve been organized.

- Ecommerce businesses should calculate the BEP to know the minimum for the production expenses.

- It can be a pretty seamless process when you partner with an ecommerce accountant who has multi-state sales tax experience.

- You have decided not to put all our eggs in one basket, so you are selling products on multiple channels.

- E-commerce accounting needs e-commerce bookkeeping to function successfully.

- The higher the gross margin, the more capital a company retains on each dollar of sales, which can be used to cover other costs or pay debts.

- Therefore, your books need to reflect the difference between gross sales, sales tax, merchant fees, and the final deposit on your bank statement.

- If you offer gift cards, a typical sale means someone pays you, and you give them a gift card at that moment.

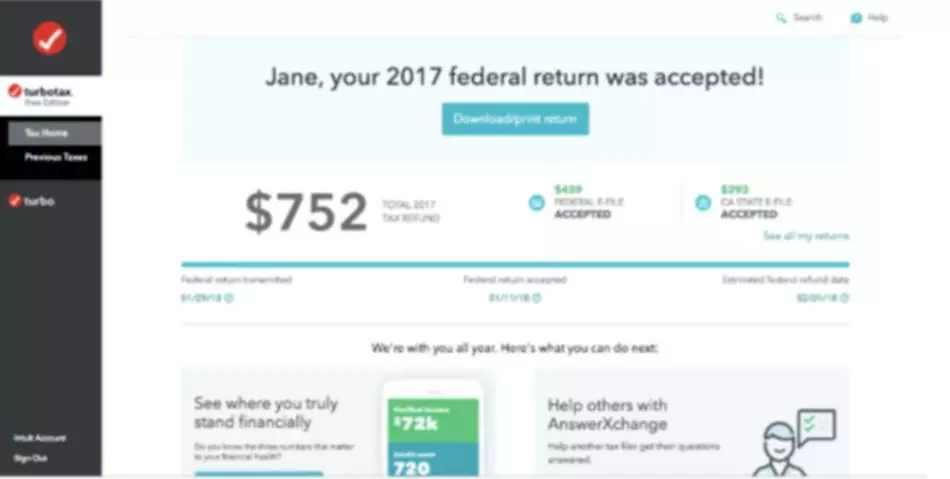

It doesn’t take much computer-savviness to perform the necessary functions. Manually tracking via spreadsheets is doable when you’re small, but it’s a problematic bookkeeping method to keep as you scale your business. Accurate, up-to-date bookkeeping is key to a stress-free tax season. Keeping detailed financial records will help you find and claim all the available small business tax deductions, which means more money for you.

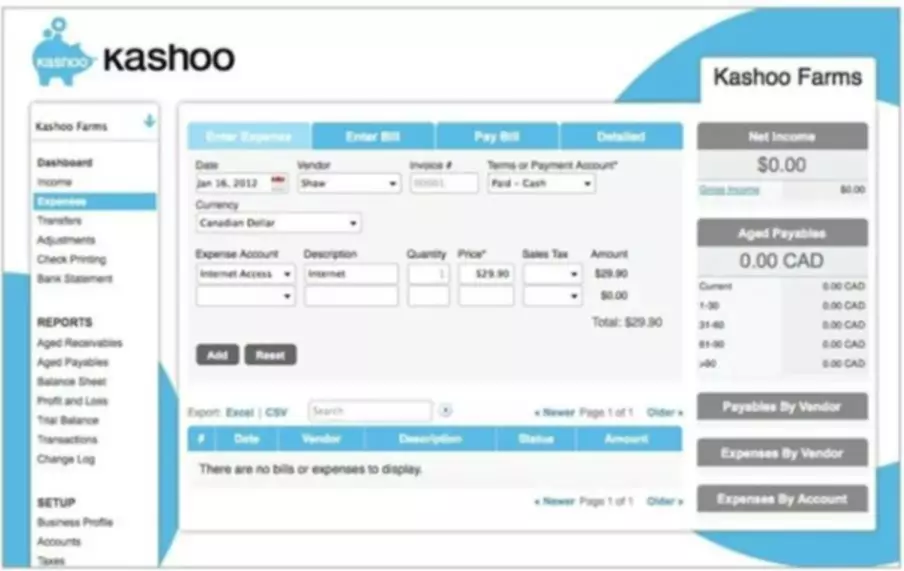

Ecommerce Bookkeeping: 4 Must-Have Software Features

Hopefully, you’re convinced that bookkeeping isn’t just an expense for your business. Instead, inventory should be held on the balance sheet as an asset until the https://www.bookstime.com/articles/ecommerce-bookkeeping inventory is sold. Because when you expense inventory right when you purchase it, it becomes difficult to understand whether your business is profitable or not.

For brick & mortar businesses, the gross margin is essentially revenue minus cost of goods sold, better known as COGS. In this blog, we’ll cover the top 6 reasons ecommerce accounting is different than accounting for other businesses and what to look out for with your current bookkeeping. The first way of accounting for differences between shipping income and spending is to keep everything in one COGS Shipping Expense account.

ECommerce is fuelled by technology, meaning that eCommerce clients are incredibly open to learning and using new tech in their own business. Forget trying to persuade a client that cloud accounting really is safer – online retailers will happily adopt new software that makes your life easier and their life cheaper. Hiring an eCommerce bookkeeper from Wishup can save you a lot of money. All our services are reasonably priced, starting at just $999 a month. Many business owners may not be familiar with the financial business aspects. They may not know about the tools needed for bookkeeping.

Can I do my accounting in Shopify?

Shopify allows integrations with cloud-based accounting software. Some of the most popular options are FreshBooks, QuickBooks, and Xero. The integration is pretty seamless. You can start using an accounting add-on in Shopify in no time.

You should be aware that this is a liability issue for your business now. Recording your financial data is the most fundamental part of bookkeeping, but it won’t do you much good if you can’t access and understand your records. Bookkeeping entails correctly categorizing, organizing, and storing your financial transactions to help with taxes and audits and to provide business insights. However, ecommerce businesses should also consider conversion rate and staffing costs. With these and several other factors, you can estimate the profitability of an SKU. There’s a lot of talk about how it’s essential to follow your gut in business.

This is the most crucial piece of information for bookkeeping for online business. The cash flow statement contains the details of every penny a business spends. It includes information about the rent, inventory, and income stream. Third-party payment platforms like PayPal can complicate record-keeping. You may sell a product via Shopify, but the payment goes through Stripe.